Bitcoin (BTC) and Bitcoin Cash (BCH) are two cryptocurrencies vying for the crown of ranking Bitcoin cryptocurrency. The Bitcoin blockchain – an open source, decentralized algorithmic code – gave rise to both digital currencies. They emanated from the Blockchain fork. Bitcoin is the world’s oldest and most recognizable cryptocurrency, and it retains its rank as the leading digital currency in the world. However, at inception the enigmatic and elusive founder of Bitcoin – ‘Satoshi Nakamoto’ – wanted the cryptocurrency to be a store of value and a medium of exchange.

That underlying thought is what precipitated the Bitcoin hard fork on Tuesday, August 1, 2017. On the one end of the spectrum Bitcoin Cash (BCH) is likely to have no fees as a payment channel, while Bitcoin (BTC) will not be focused on the fees component and will be a store of value. Proponents and opponents of existing cryptocurrency technology are split on how best to proceed with the code.

Bitcoin Price and Performance

The overarching goal of Bitcoin technology is widescale adoption. The question of whether Bitcoin (BTC) or Bitcoin Cash (BCH) is better suited to traders, investors or laypeople is a challenging one. It’s all about scaling, utilization, decentralizing the cryptocurrency, minimizing fees and rapidly executing transactions.

Bitcoin Cash Price and Performance

If the rumours are true, then Bitcoin is artificially centralized at the upper echelons. Bitcoin Cash is attempting to be something that Bitcoin is not: a store of value and a medium of exchange. The SegWit hard fork on August 1, 2017 was a watershed moment for Bitcoin. At inception, Bitcoin Cash was trading around the $300 – $600 range.

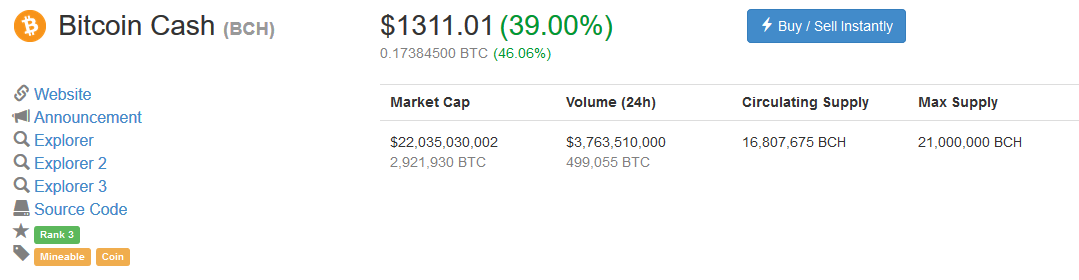

By November 17, 2017 Bitcoin Cash was trading at $1,311,00. The circulating supply of Bitcoin Cash is 16,807,675 and the total supply is 21 million. Note that these are almost the same quantities as Bitcoin. However, the market capitalization of Bitcoin is $125.85 billion, while the market capitalization of Bitcoin Cash is $22.035 billion.

Is BCH Worthy of the Bitcoin Name?

Bitcoin Cash (BCH) is poised to become the default digital currency. Within the cryptocurrency community there are many folks who believe that the name ‘Bitcoin’ should not be used when describing BCH – that it should simply be Bcash. Currently, the biggest market for Bitcoin is South Korea where some 80% of the market’s transactional value is conducted.

Bitcoin Cash gained prominence after the SegWit attack on Bitcoin’s fundamentals – like its decentralized nature and its lack of widespread adoption. From a technical standpoint, Bitcoin Cash (BCH) allows for fully customized block sizing. Bitcoin (BTC) on the other hand is limited to 1 mb blocks only. In other words, it’s a lot slower to process and work with. Much like the original, pristine vision of Satoshi Nakamoto, Bitcoin Cash is designed to be the ultimate decentralized digital currency with no third-party interference. Bitcoin Cash is posing a serious challenge to Ethereum, formerly the #2 Altcoin and digital currency. Bitcoin buyers who own a Bitcoin wallet with currency in it before August 1, 2017 can choose between Bitcoin or Bitcoin Cash.

Provided the private keys are controlled by the investor/trader and not the exchange, either BTC or BCH is owned. Presently, the Bitcoin market is being driven by large speculators. People with 100s of Bitcoin (valued at millions of dollars) are buying and selling digital currency en masse. Owing to the difficulties of determining the intrinsic and/or extrinsic value of Bitcoin, it is foolhardy to promote the buying or selling of either one. If BCH is the transactional currency and Bitcoin is the Monetary Base (like the Fed), then both can co-exist in a happy medium.