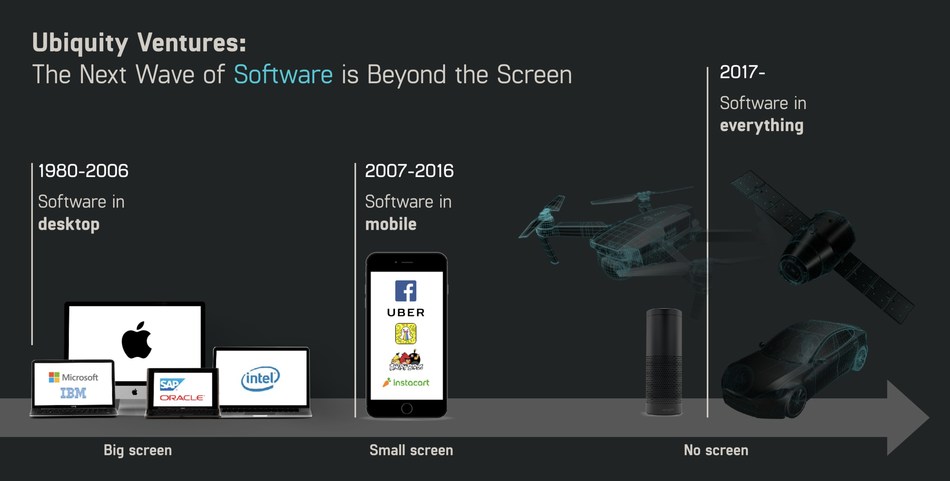

Ubiquity Ventures, a Palo Alto, Calif.-based seed-stage institutional venture capital firm that invests in “software beyond the screen” startups, closed its second fund, at over $50M.

Based on its performance in its 2017 debut fund, the firm will continue to back “software beyond the screen” companies that utilize smart hardware and machine learning to solve business problems outside the domain of computers and smartphones.

Led by Sunil Nagaraj, Founding Partner, Ubiquity Ventures is a seed-stage institutional venture capital firm that invests companies using smart hardware and machine intelligence to move real world physical problems into the domain of software where they can be solved much more effectively.

The firm now has close to $100m of assets under management and 25 portfolio companies.

As an investor, Nagaraj has an extensive track record in venture capital with $14 billion of exits earlier this year, including the sale of Auth0 to Okta for $6.5 billion. He was Auth0’s first VC investor while a Principal at Bessemer Venture Partners. He led the company’s seed round, was their first board member, and eventually led Auth0’s Series A.

FinSMEs

24/06/2021