Ledgy, a Zurich, Switzerland-based equity management platform built for high-growth companies, raised $10m n Series A funding.

The round was led by Sequoia Capital with participation from Xavier Niel, Harry Stebbings, Visionaries Club, and several SaaS founders including UiPath’s Daniel Dines and Front’s Mathilde Collin, as well as existing investors Myke Näf, Paul Sevinç, btov Partners, Creathor Ventures and VI Partners. In conjunction with the funding, Sequoia partner Luciana Lixandru is joining Ledgy’s board.

The company intends to use the funds to continue to continue expanding into new markets within Europe and beyond, as well as building new features to support workflow automations, solutions for public company administration, and enhanced fund and portfolio management capabilities.

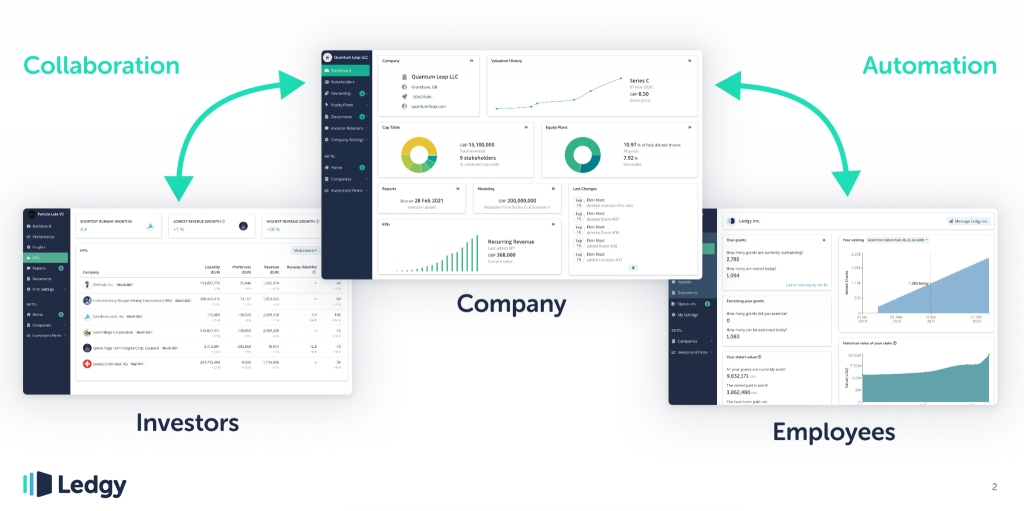

Founded in 2017 by ETH Zurich physics graduates Yoko Spirig, Ben-Elias Brandt and Timo Horstschäfer, Ledgy provides an equity management platform for company ownership that can be used, for the benefit of companies and funds, in any jurisdiction and from founding to IPO and beyond. As companies expand into new territories, establish offices in new markets, and bring new investors on board, the software allows users to automate the administration of a number of the business processes, from cap table management through to setting up option plans and modelling exit scenarios.

Ledgy also offers VC and angel investors the ability to manage their portfolios of investments through a single hub and collaborate with companies on reporting and KPIs.

Today, wefox, Kry, Bitpanda and Pleo, use the company’s platform to close funding rounds, engage investors and empower employees. In total, Ledgy is used by more than 1,500 businesses.

FinSMEs

07/09/2021