Stake, a NYC-based fintech company focused on powering real estate with Cash Back rewards, raised over 4m in seed funding.

The round was led by Shadow Ventures, with participation from Hometeam Ventures, Olive Tree Holdings, Blue Field Capital, Hampton VC, Gaingels, and Ellen Levy, Managing Director at Silicon Valley Connect.

The company intends to use the funds to expand operations and its business reach.

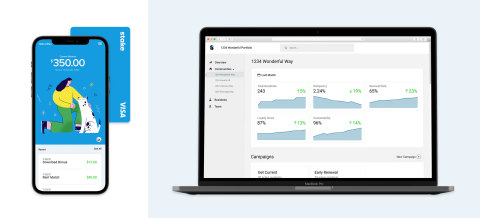

Co-founded by Rowland Hobbs and Jimmy Jacobson, Stake provides a Rewards App for renters and a data-driven cloud-based dashboard for property and asset managers. It enables owners and operators—from Greystar to Brick Capital to Apartments Management Consultants and Legacy Wealth Holdings—to decrease spend on concessions and incentives by over 50%, lease-up twice as fast, reduce delinquencies up to 50%, and boost top-line revenue with a 7-15% increase in retention and renewals. Stake is currently offered in over $1 billion of real estate assets, representing $150 million in Gross Lease Value, and available to over 10,000 residents.

FinSMEs

28/09/2021