FairPlay, a NYC-based “Fairness-as-a-Service” solution for algorithmic decision-making, raised $4.5M in seed funding.

The round was led by Third Prime Capital, with participation from FinVC, TTV, Financial Venture Studio, Amara, and Nevcaut Ventures.

The funding will go towards the continued growth and development of the team of machine learning engineers and data scientists.

Led by Founder & CEO Kareem Saleh, FairPlay is an AI fairness solution for any company that uses algorithms to make high stakes decisions about people’s lives.

The software answers 5 key questions for customers: 1) Is my algorithm biased? 2) If so, why? 3) Could it be fairer? 4) What is the economic impact of being fairer? 5) Did we give our declines a Second Look to see if they resemble good applicants on dimensions we haven’t heavily considered?

FairPlay is going to market in financial services with two APIs. The first API provides Fairness Analysis, analyzing a lending model’s inputs, outputs and outcomes to provide insights into whether disparities exist and for which protected groups.

The second API, called Second Look, re-underwrites declined loan applications using AI fairness techniques that are designed to do a job of assessing borrowers from underserved groups. These techniques can determine whether declined applicants resemble “good” borrowers in ways that the primary algorithm did not consider. The result is that more applicants of color, women and other historically disadvantaged people are approved.

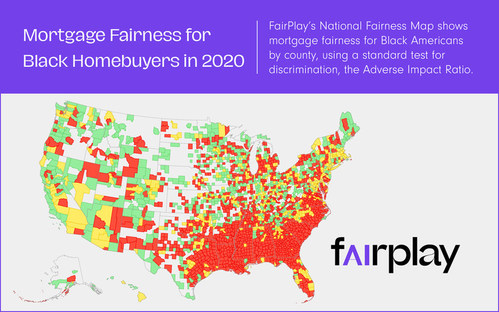

Fairplay is also announcing the launch of its Mortgage Fairness Monitor, a detailed and data-driven map of how fair the mortgage market is to Black Americans, women and Hispanic Americans based on a review of 20 major metropolitan areas in the U.S. FairPlay is releasing a ranking of these 20 major American cities based on their mortgage fairness for the above groups. (All results are based on 2020 data. The control group for female, Black homebuyers & Hispanic homebuyers is white male homebuyers. The control group for Millennial & Baby Boomer homebuyers is Gen X homebuyers.)

Results from the Mortgage Fairness Monitor include:

- The following 5 U.S. cities were the fairest for Black homebuyers (ranked from most fair to least fair): Los Angeles, CA; Portland, OR; Las Vegas, NV; San Francisco, CA; Phoenix, AZ.

- The following 5 U.S. cities were the LEAST fair for Black homebuyers (ranked from most unfair to least unfair): Cleveland, OH; Detroit, MI; Chicago, IL; Miami, FL; Atlanta, GA.

- The following 5 U.S. cities were the fairest for female homebuyers: Los Angeles, CA; New York, NY; Las Vegas, NV; San Diego, CA; Portland, OR.

- The following 5 U.S. cities were the fairest for Hispanic homebuyers: Miami, FL; Los Angeles, CA; Phoenix, AZ; San Diego, CA; Las Vegas, NV.

- The following 5 U.S. cities were the fairest for Millennial homebuyers: New York, NY; Miami, FL; Chicago, IL; Cleveland, OH; Tampa, FL.

- The following 5 U.S. cities were the fairest for Baby Boomer homebuyers: Phoenix, AZ; Las Vegas, NV; Charlotte, NC; Minneapolis, MN; San Diego, CA.

FinSMEs

15/11/2021