Aisot Technologies, a spin-off from ETH Zurich (Switzerland) developing AI-powered portfolio insights for equity and crypto markets, raised CHF 1.8M in Seed funding.

The round was led by Haute Capital Partners, joined by the Swiss ICT Investor Club (SICTIC), and angel investors.

The company intends to use the funds to add key people to the team and support critical customer demands, product development and growth initiatives.

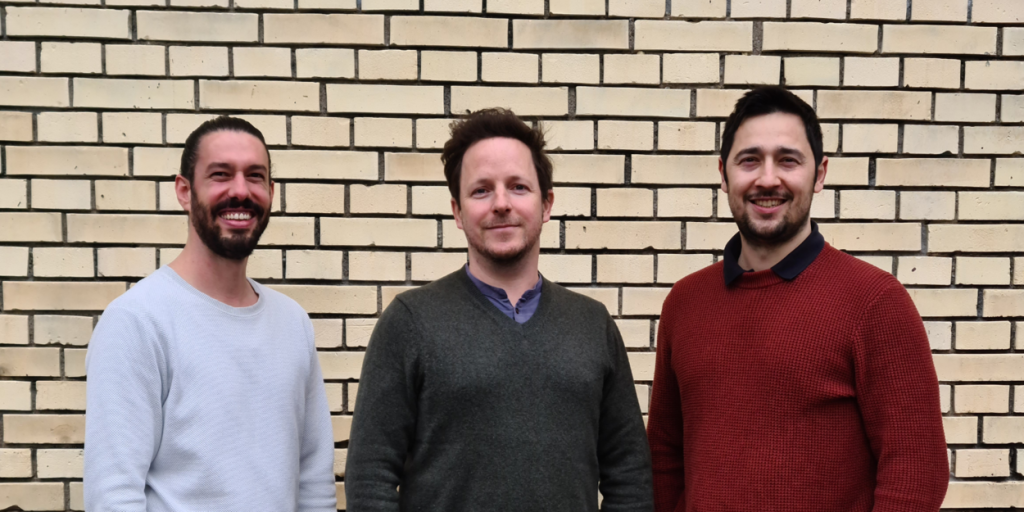

Led by CEO Stefan Klauser, Roger Peyer, CTO, and Dr. Nino Antulov-Fantulin, Head of Research & Co-Founder, Aisot Technologies aims to innovate asset management with AI, leveraging the combined power of machine learning, data science, and quant research. Making asset management fully customizable, the company allows asset managers to automatically adapt to the changing needs and condition of the market. aisot dynamically leverages different data sources with mixed characteristics, such as market and alternative data streams, and outperforms a variety of statistical and machine learning baselines as well as industry standards. The company provides a fully comprehensive suite of products for asset and wealth managers including optimized portfolios and asset allocation as well as risk and return predictions.

In 2022, aisot launched an U.S. equity product and onboarded UX Wealth as client. On the crypto side, the company onboarded a Switzerland-based fund, backing the world’s first AI-driven crypto AMC (actively managed certificate). In addition, aisot is set to launch additional AMCs in spring 2023.

This new round of funding brings aisot’s total funding to CHF 2.3M. Zurich-based accelerator Tenity (formerly F10) and friends and family provided a CHF 0.5M pre-seed round in 2021.

FinSMEs

09/03/2023