Frec, a San Francisco, CA-based provider of a suite of automated self-service products to simplify investment products usually available via wealth managers, emerged from stealth raising $26.4m in Series A funding.

The round was led by Greylock with participation from Social Leverage and others.

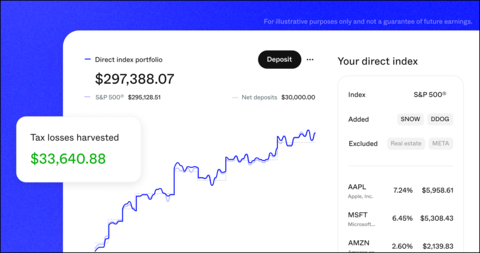

Led by Mo Al Adham, founder, Frec offers a suite of automated self-service products to simplify sophisticated investment products traditionally only available via wealth managers, including direct indexing, portfolio lines of credit, and high-yield treasury. Its flagship product, Frec Direct Indexing, is one of the first direct-to-consumer products that enables customers to track S&P2 indices – delivering the benefits of index investing, with added tax savings and customization.

Frec today also announced:

– Frec Treasury, offering up to 5.02% on cash.

– Portfolio lines of credit, enabling customers to borrow up to a certain percentage of their stock holdings, without a complicated setup.

– A partnership with AngelList, powering money market funds natively for venture capital funds. AngelList venture funds can earn yield on their cash in money market funds through Frec.

FinSMEs

03/10/2023