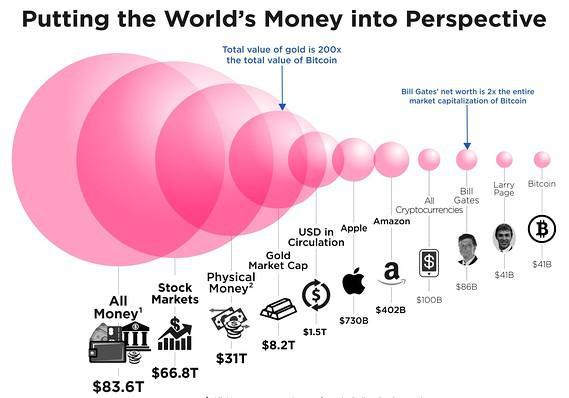

Bitcoin continues to make headlines in the mainstream press where it is often hailed as the harbinger of a new financial age wherein the existing global monetary system will be upended. Bitcoin is still very much in its infancy, as evidenced by perhaps surprising statistics published last summer by HowMuch.net, which shows its entire market capitalization of $41 billion is still some way short of even Bill Gates’ net worth and remains just the tiniest fraction of the $66.8 trillion traded on stock markets.

Source: HowMuch.net

So, what exactly is bitcoin?

Bitcoin is a genuinely decentralized digital currency, which means there is not a government or a third party controlling or managing it. There is no single point of failure either. Owners are anonymous, and the marketplace is driven by encryption keys, which facilitate transactions by connecting buyers and sellers. That allows people to bypass traditional forms of payment and financial institutions to procure goods and services. As there is no single power to print or distribute the currency, bitcoin is “mined.”

Bitcoin mining

Bitcoin uses blockchain technology, which is a method of recording data. The blockchain can act as a digital ledger for anything of value including transactions, agreements, and contacts. The main difference is that this ledger is not stored in a single place but is distributed instead to a network of thousands of computers located around the world. “Blocks” are made up of digital records and are bound together into chains using mathematical algorithms. That encryption process is known as “hashing.” “Mining” is the process of solving the complicated algorithms, and it requires significant computational power.

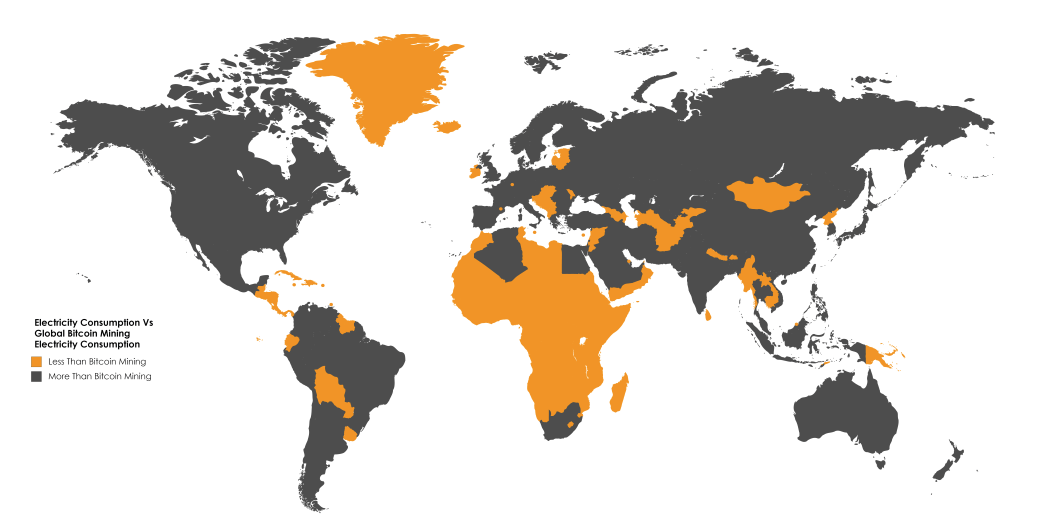

The energy spent on mining bitcoin has already surpassed the average amount of electricity consumed on an annual basis by almost 160 nations across the globe. eToro senior market analyst, Mati Greenspan believes that is an area where bitcoin and other currencies will need to improve in the future by reducing energy consumption and allowing the network to scale effectively. He adds: “If bitcoin is to replace cash in the long run it will need to be fitted to process more than 100,000 transactions per second. Now, it can do about 10. Many proposals are on the table but as the currency is decentralized it’s difficult to get everybody to agree on one.”

Source: Powercompare.co.uk

Alternative cryptographic currencies

Bitcoin is just one of a variety of cryptographic currencies, some with unique characteristics and others that are mostly copy and paste clones. Ethereum is currently among the most viable alternatives to bitcoin as it differentiates itself through a sharper focus on the technical side of blockchain development, and the ability to use native tokens and smart contacts. Bitcoin could also incorporate those features into its ecosystem in the future. Cryptocurrencies are not static and can evolve and develop over time.

Ripple (XRP) is another currency tipped as being a potential rival to bitcoin. The platform is designed around speed and its aim to allow banks and other institutions to send payments in real time. Ripple claims banks can save almost $4 for every payment made as it takes just four seconds to process, which is significantly faster than other cryptocurrencies. However, its benefits are offset by its open nature, which increases the risk of cyberattacks.

Source: Ripplecoinnews.com

Criminal activity

Whether the bitcoin boom can be sustained is one topic that is currently dominating the conversation, but there are darker undertones to the rise of the cryptocurrencies, as criminal enterprises are responsible in part for its value. Cryptocurrency can facilitate criminal activities such as money laundering, extortion, tax evasion and contraband transactions. Bitcoin has also, in part, fuelled the recent explosion in the number of ransomware attacks. “The existence of effectively anonymized payment mechanisms definitely plays into the hands of cybercriminals,” Kaspersky Lab principal security researcher, David Emm says.

Source: Economist.com

The link between cash and crime is well known, but the untraceable nature of cryptocurrencies is now encouraging a new wave of illegal transactions. “For individuals and organisations conducting illicit activities, cash is undoubtedly the preferred payment mechanism,” Harvard president emeritus, Peter Sands says. Without access to paper money, criminals would have to use other means of exchange, which would expose their financial affairs to a third party. Bitcoin has emerged as a viable alternative as it provides the anonymity criminals crave in the digital age. Eliminating cryptocurrencies and cutting the supply of cash would make it incredibly challenging for terror and criminal organisations to operate. It would reduce a significant number of illegal activities, including drug trafficking, the trading of weapons and trafficking of women. Concealing identities via anonymous wire transfers is also a problem, but cryptology does not have to be an “enabler” for crime, as transparent and regulated deals would eliminate potential unlawful activity.

What the world’s central banks are saying

Central banks are finally beginning to recognize how digital currencies could change international finance. The Federal Reserve has started an investigation into cryptocurrencies, with vice chairman, Randal Quarles, revealing that regulation may be “worth thinking about”, though there is no central bank policy on the horizon. The EU also wants to regulate cryptocurrencies to bring them under the umbrella of counterterrorism and anti-money laundering legislation. However, Fortytwo Data CEO, Julian Dixon says the US is currently “way ahead” of the rest. He adds: “The US Treasury classified bitcoin as a convertible decentralized virtual currency in 2013. Two years later, the Commodity Futures Trading Commission classified bitcoin as a commodity in September 2015.”

Accepting Bitcoin

The inherently volatile nature of cryptocurrencies and its link to criminal activity suggests enterprises should think twice about jumping on the bitcoin train when accepting payments. While there are risks, bitcoin does offer distinct advantages for both small businesses and large corporations. Transaction fees are lower compared to credit and debit cards, payments are credited to accounts faster, and it reduces a customer’s exposure to fraud because sensitive personal information does not have to be stored.

Investing in Bitcoin

Bitcoin remains a speculative investment because the market is unregulated and volatile, but for those with a place in their strategies or portfolios for high-risk investment, it offers the potential for very high returns. A new financial product called bitcoin futures launched late last year; it allows investors to bet on the price of bitcoin on an agreed upon date in the future. However, it is currently not possible to buy “short” against it to profit from a potential decline in value.

Investing money into a cryptocurrency such as bitcoin can be compared in some degree to spending money at a casino. The casino is a scientific, regulated system built to favour the “house”, but players that play responsibly and apply a modicum of strategy in poker and roulette can enjoy the thrill of placing bets and the possibility of winning large amounts of money. You might want to consult with this comprehensive roulette odds guide to help players to improve their chances of success.

Will the bubble burst?

On January 16, 2018, the price of bitcoin plunged by 20 per cent to below $12,000, a notable come down from the $19,783 peak a month earlier. The latest slump adds weight to the theory that the bitcoin bubble will eventually burst, but the currency has seen its fair share of sharp moves in both directions during the last twelve months. Volumes in bitcoin futures continue to soar, and experts believe stricter regulations will be enforced as the currency becomes more prevalent, which in turn, could reduce its appeal as the veil of anonymity has been central to its popularity.

South Korea announced early in the new year that its government would tighten control over trading, while Chinese authorities set in motion plans to close a selection of large bitcoin mining operations. The cryptocurrency landscape is sure to be as ever-changing and volatile as its value, so it’s difficult to say for sure whether it will blossom and become a mainstream success or be usurped by another currency and merely return to its darknet, crypto-enthusiast roots. What is certain, is that cryptocurrencies will not die. ICO market veteran, Brock Pierce concludes: “This is going to be the technology that democratizes the global financial system so everybody has equal access.”