CoinDesk, a New York City-based global leader in crypto and blockchain news, events, data and research, acquired TradeBlock, a provider of digital asset reference rates.

The amount of the deal was not disclosed.

With this acquisition, TradeBlock becomes a wholly owned subsidiary of CoinDesk that will operate completely independently of the media operation. The entire TradeBlock team will stay with the company in the acquisition.

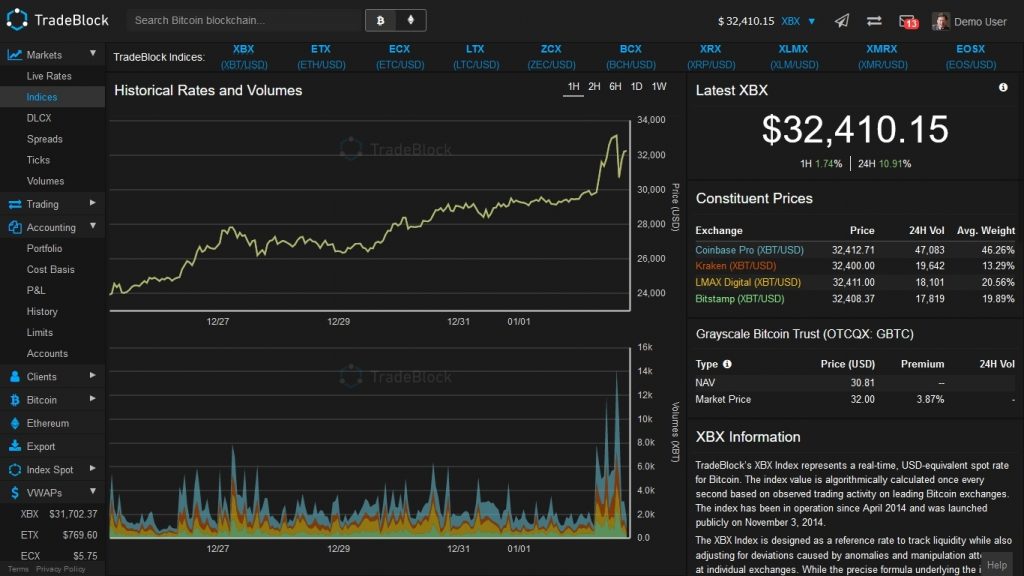

Led by CEO Nitai Bran, TradeBlock has built the industry standard for institutional-grade digital currency price references. TradeBlock offers advanced indexes and reference rates, consolidated APIs, historical trade and order-book data, and customizable algorithms. Today, its products serve institutional bitcoin traders, featuring market analytics, blockchain insights, order management, trade execution, team communication and compliance automation. Currently, more than $20 billion of investment products use its indexes, and billions of dollars in monthly trading volume is quoted against them.

Founded in May 2013 and led by Kevin Worth, CEO, CoinDesk provides millions of consumers interested in cryptocurrency assets and blockchain technology with news and insights, podcasts, live streaming TV shows, research reports, live events, and now will offer a new toolkit of indexes, data and analytics. The company will now invest in the index and data business and in TradeBlock’s order management platform and enterprise trading tools, building for the long-term to serve TradeBlock’s list of institutional clients. At the same time, the company will continue to invest in expanding its mass global audience for news and events, as well as TradeBlock’s institutional-grade data and reference rates.

CoinDesk hosts the annual Consensus summit event each May, the largest and most important forward-thinking U.S. gathering of stakeholders in the global crypto and blockchain ecosystem and the anchor event for Blockchain Week NYC.

CoinDesk’s parent company, Digital Currency Group, was a minority shareholder in TradeBlock prior to the deal. Grayscale Investments, which manages the Grayscale Bitcoin Trust, is a wholly owned subsidiary of DCG.

The company has over 80 full-time employees around the world.

FinSMEs

07/01/2020