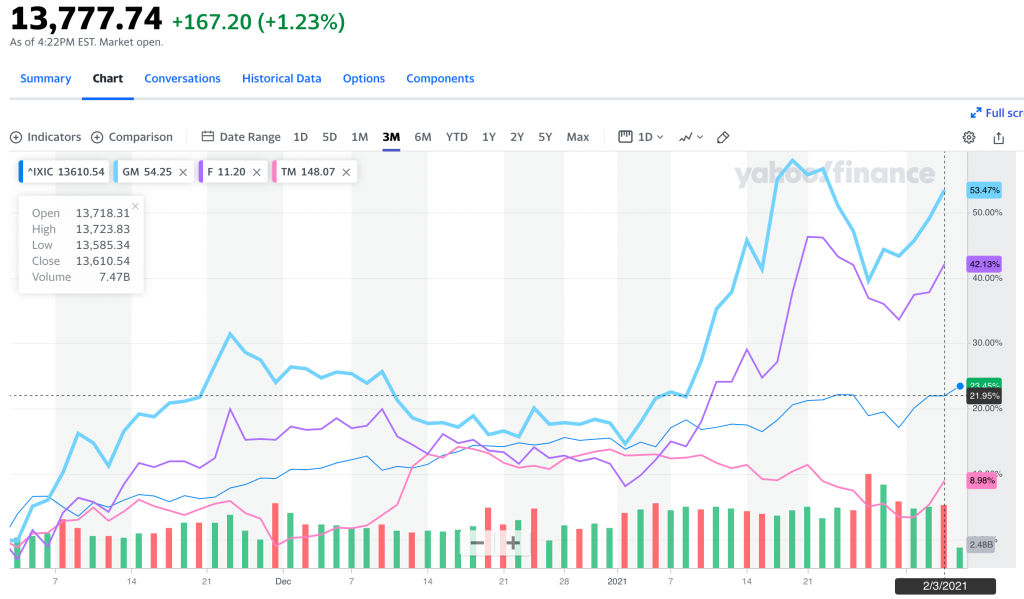

The NASDAQ composite index is riding a wave of unprecedented bullishness. The ‘shock retreat’ of equities in April and May 2020 is a thing of the past. Markets are rallying for a variety of reasons, and traders are licking their lips in anticipation. There is still plenty of gas in the tank, provided you’re fueling your portfolio with the right stocks.

Source: Macrotrends NASDAQ YTD and Dow Jones YTD

The year-to-date performance (through February 4, 2021) for major US indices is positive. Starting with the Dow Jones Industrial Average, gains are anemic, but positive at 0.4%.

For the NASDAQ composite index, the year-to-date performance is +5.6%, and for the S&P 500 index, the gains are +3.08%.

The figures hardly inspire confidence, but when viewed in perspective they are actually incredibly strong. Let’s take a look at several leading stocks to watch in 2021.

Top Stocks to Watch in February 2021

Palantir Tech Inc (NYSE: PLTR)

Palantir Technologies, Inc (NYSE: PLTR) is currently trading around $32.05, marginally higher than its 50-day moving average of $27.59. Given that this is a new stock with an undefined 200-day moving average, traders don’t have a whole lot to go on other than recent price performance.

PLTR will be releasing its earnings report on 16 February, 2021, and Wall Street investors will be looking for any signs of positive sentiment to go long on the stock.

Based on forward price/earnings ratios, PLTR is considered overpriced, because its valuation is way above the industry average. The company is owned by former PayPal founder, Peter Thiel. The recently-announced IPO allowed for a straight shot breakout above $30, netting day traders a handsome profit in the process.

Despite downwardly revised prices in recent trading sessions, the price indicators remain somewhat bullish moving forward, with the Ichimoku Cloud green ahead of the current pricing. Even the Bollinger Bands – another powerful technical indicator – reflect that current prices are well within the upper and lower band limits, with growth prospects moving forward.

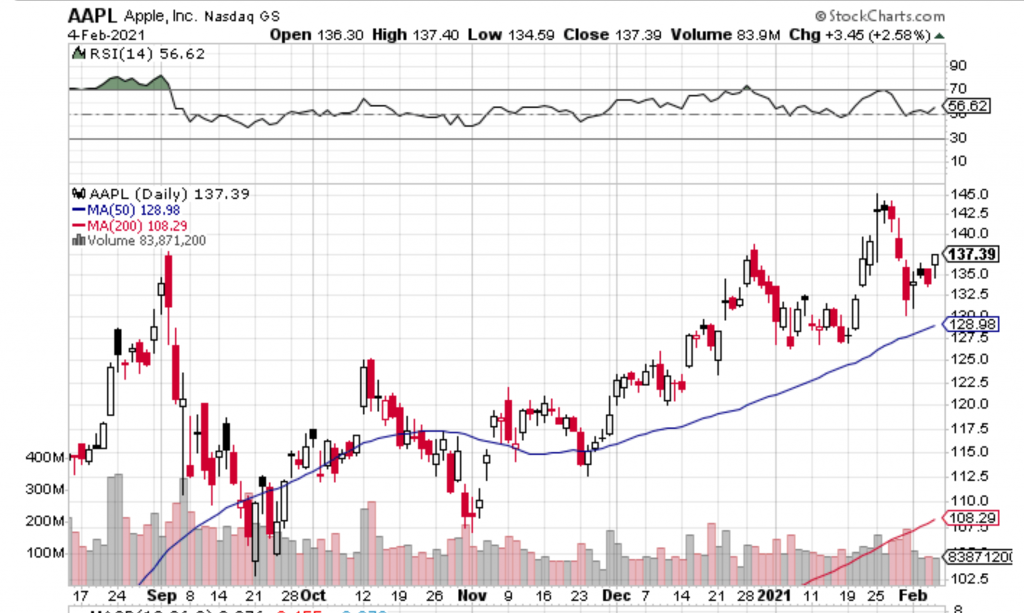

Apple Inc (NASDAQ: AAPL)

Apple Inc is currently trading around $137.39 per share, substantially higher than the short term moving average of $128.98, and the long-term moving average of $108.29. Apple’s popularity is a testament to the enduring loyalty of Apple’s fans to the brand. For the year to date, Apple has whipsawed wildly, from an opening price of $131.05 to $144.23 on January 25, 2021.

Despite performance expectation being bearish for the short-term and medium-term, Apple is a neutral long-term stock. The company declared dividends on Friday 5 February 2021, and based on expected EPS consistently being beaten by actual earnings, stockholders are on a good wicket.

The one-year target estimate price for Apple is $150 according to Yahoo! Finance analysts. On a ratings scale of 1 (Strong buy) to 5 (sell), Apple is regarded as a buy at 2.

Sunworks Inc (NASDAQ: SUNW)

Green energy is all the rage nowadays. This is especially true in the wake of a Biden presidency, and the clean energy agenda the Democrats have rolled out. Alternative energy stocks such as Sunworks Inc are looking particularly attractive to investors. The technical indicators are less bullish on the, with lots of crisscrossing below the Ichimoku Cloud with the stock.

The stock is currently trading at $21.37 per share, but it has had a good run of form in 2021 to date. It started trading at $4.96 and priced almost 5 times higher. The earnings date is slated for the end of March, early April, and the company’s market cap is over $500 million. On a scale of 1 (strong buy) to 5 (sell), the stock is rated at 3, as a hold. This clean energy Star may gain traction with the new administration.

At the time of writing, these charts, graphs, and prices were accurate (February 5, 2021).